Share

In 2007, the government released guidelines for landlords concerning collecting deposits from tenants as part of assured shorthold tenancy agreements. These guidelines, called ‘Tenant Deposit Protection’, state that the landlords based in the UK or Wales, should place their tenants deposit within one of 3 approved protection schemes:

Landlords that breach these new rules, may face a compensation claim and potential court prosecution by their tenants. In some cases, the court may decide you need to repay your tenants up to 3 times their deposit amount. A landlord who has not correctly protected a deposit also cannot serve a notice to end the tenancy and regain possession of it under section 21 of the Housing Act 1988.

What is a tenant deposit?

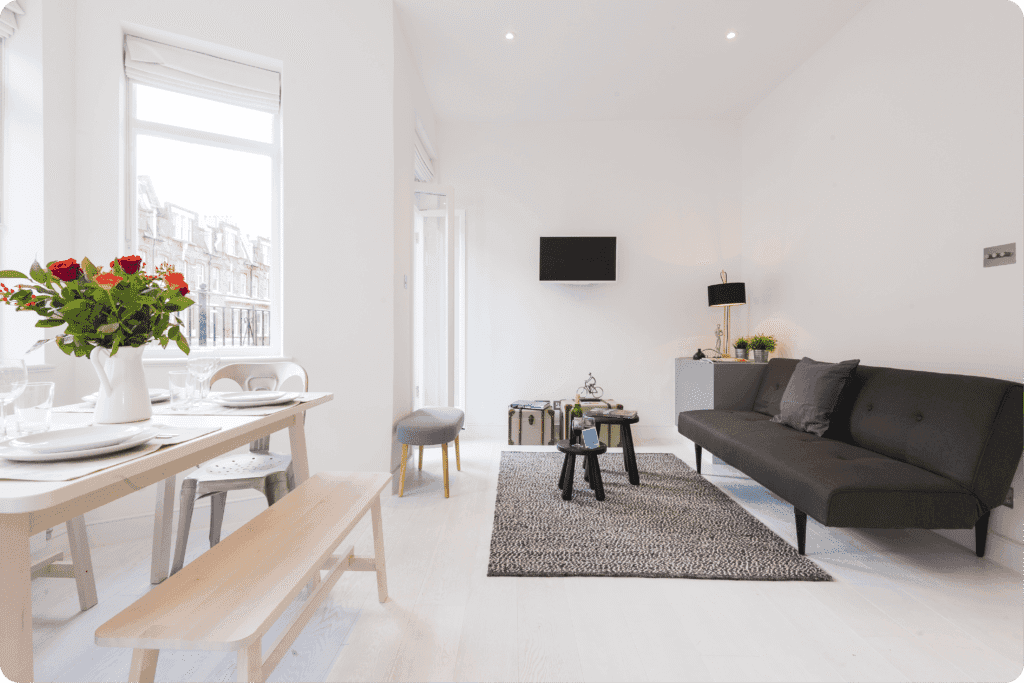

The tenant deposit exists to protect the landlord from damage caused by the tenant to the property, above reasonable wear and tear. For example, this could include cleaning costs, where the property is not returned to the landlord in the same condition as it was given initially, or could be for the cost of replacing missing or damaged furniture on a like-for-like basis i.e. bed frames, mirrors, carpets, doors etc.

If rent remains unpaid at the end of the tenancy, or the tenant has bills outstanding, the landlord can also deduct this sum from the tenants deposit.

Process for securing deposits

In 2019, under the Tenant Fees Act, tenancy deposits are now capped at the equivalent of 5 weeks rent when annual rental totals under £50,000.

The landlord is responsible for requesting the deposit from the tenants as part of the moving in process and subsequently registering and protecting the deposit with one of the 3 above schemes, paying any required subscription fees.

Once this is complete, the scheme will provide a ‘prescribed information’ document which includes confirmation of the protection, the deposit amount and the address details of the tenant. The landlord needs to complete this process and send over relevant documents within 30 days of receiving the deposit from the tenant.

Claims and tenant disputes

At the end of a tenancy, if there is to be no deductions to the deposit for underpayment of rent or property damage, the landlord should return the full deposit to the tenants as soon as possible.

However, if the landlord feels there are deductions to be made, then the landlord should approach the tenant for agreement on fair costs to repair and replace particular items. This is why it is important for the landlord to invest in both check-in and check-out inventory reports, showcasing evidence of the property and items pre and post tenancy. These reports are completed by an independent body and are mutually agreed by both parties at the beginning and end of the tenancy. If inventory reports haven’t been completed, it can be harder for the landlord to prove the state of the property at the beginning of the tenancy and therefore the extent of the proposed damage.

If both parties can come to a fair and reasonable agreement, the landlord can propose deductions within the protection scheme, for which the scheme will approach the tenant for agreement of the charges, usually via email. If agreed, the deposit less costs, is released back to the tenant.

If both parties cannot agree on a solution, the tenant and landlord can agree to apply to the protection scheme for free dispute management, and evidence from both sides will need to be supplied. The protection scheme acts as a third party to resolve the dispute, involving additional independent adjudicators if necessary, within 3 months of the tenancy ending.

So, whilst letting your home is a great way to secure additional income, it also comes with its challenges and stresses. This is where City Relay can help. We are proud to be London’s most trusted property management agency, offering an all-in-one service to our landlords including liaising with tenants, contract negotiations, protecting deposits, and best practise advice for you as the landlord. Find out more about our services and pricing or contact us now to find out how we can help you manage your property.